Thanks to the expertise Simon McWilliams in terms of financial audit, Tether would like the other to lead a complete financial audit. The aim of the company is to become more transparent on its reserves, while regulatory pressure intensifies especially in Europe.

Tether calls a new CFO

According to the latest announcement, Tether Simon McWilliams named the new CFO (CFO). With this appointment, Tether is trying to strengthen the confidence of users, regulatory bodies and institutional partners in consolidation of his dominant position on the Stablecoins market.

“The expertise of Simon McWilliams in financial audits makes it the ideal CFO that leads in this new era of transparency. Below it, we will definitely move towards a complete audit and strengthen our role to support the financial strength of the United States and the extended institutional commitment, ”wrote Paolo Ardoino, CEO of Tether.

With a very long trajectory, Simon McWilliams brings more than 20 years of financial management experience. He previously worked on large investment companies in performing strict audits.

His appointment therefore means a significant step for society, mainly because of the persistent skepticism of the legitimacy and transparency of his reserves.

Calls to resolve the company

After the appointment of McWilliams, the former CFO in Tether, Giancarlo Devassini, will be the role of the president. In this new position, Devassini will now focus on macroeconomic strategy, direct the cover to integrate into the US financial system, and supports global acceptance of digital assets.

Under the leadership of Devasini, society has been constantly criticized for the absence of a complete audit. Since 2022, the company relied only on a quarterly certificate report from the BDO accounting company.

These messages are considered on both sides as in details. The complete audit is therefore highly expected that the veil is raised for any doubt.

This lack of transparency over the course of months has raised many questions, especially after the settlement in 2021 with the General of New York (NYAG). The NYAG survey revealed that Tether falsely said USDT was supported at 1: 1 US dollar.

In addition, Tether and Bitfinex, a closely associated society, have been accused in the past, of course manipulation.

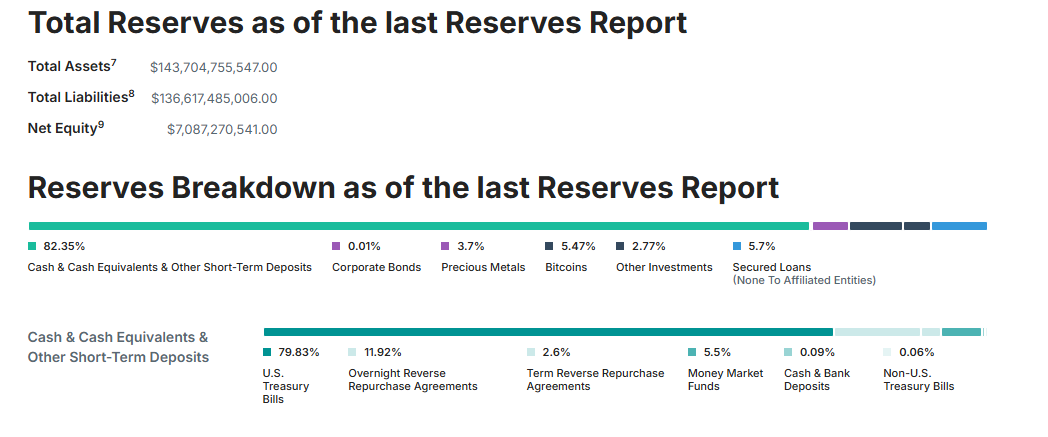

Since then, however, the company has multiplied USDT’s origin in order to reveal its reservations, which would therefore consist of 82.35 % of liquidity. More precisely, nearly 80 % of these liquidity would make up the American treasury.

However, the closest criticism claims that only a complete audit can fully dispel doubts about the financial health of the company.

In addition, the implementation of complete audit seems to combine the strategic goals of Tether because the company has recently moved its headquarters to Salvador. In order to obtain a license from a digital assets provider (DASP).

However, until the certification certification is certified through a complete audit, there will be no doubt about the company’s strategic reserves and USDT support. As a result, Stablecoin faces complications in Europe because it will soon be discarded by Binance to comply with the law of the mica.

Morality of history: bringing the clarity of darkness is the goal of pessimists, but also for USDT.

Notification of irresponsibility

Notice of non -response: In accordance with the TRUST project, Beincrypto undertakes to provide impartial and transparent information. The aim of this article is to provide accurate and relevant information. However, we invite readers to verify their own facts and consult a professional before it decides on the basis of this content.